Key App Features:

-

AI-Driven Deduction Discovery: FlyFin's sophisticated AI automatically uncovers all eligible tax deductions, including car mileage, home office expenses, and business-related meals. This significantly reduces your tax burden and frees up your time.

-

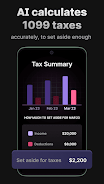

Smart Tax Savings Planning: The app meticulously tracks income, expenses, and deductions to calculate the optimal monthly savings needed to meet your tax obligations, preventing unexpected tax bills.

-

Free Resources & Calculators: Access a wealth of valuable resources, including a 1099 tax calculator, quarterly tax calculator, free CPA webinars, and comprehensive tax guides. These tools alleviate tax-related stress and provide expert guidance.

-

Automated Bookkeeping Simplified: Automate your financial record-keeping with ease. The app tracks your expenses on the go, reducing your tax preparation workload by 95%, saving you considerable time and effort.

-

Expert CPA Tax Filing (Federal & State): FlyFin's team of experienced CPAs meticulously reviews, prepares, and files your tax returns, guaranteeing the maximum possible refund and providing comprehensive audit insurance.

-

Unwavering CPA Support: Benefit from unlimited access to our CPAs with over 100 years of collective experience. Get the answers you need, whenever you need them.

In Conclusion:

FlyFin is the ultimate tax solution for freelancers and the self-employed. Its advanced AI technology streamlines the deduction process, saving you both time and money. Combined with user-friendly tools, automated bookkeeping, and the expertise of experienced CPAs, FlyFin ensures accurate tax filings and maximized refunds. FlyFin is committed to data privacy and employs state-of-the-art security measures. Download FlyFin now and take control of your financial future!