Afterpay - Buy Now, Pay Later is a revolutionary financial technology app that transforms the way consumers shop and manage their payments. This service allows users to make purchases online and in-store, spreading the cost over time in manageable installments without incurring interest or fees. Afterpay collaborates with a vast network of retailers, offering a diverse selection of products and services. The app's intuitive design and seamless checkout process make it an indispensable tool for modern shoppers.

Features of Afterpay - Buy Now, Pay Later:

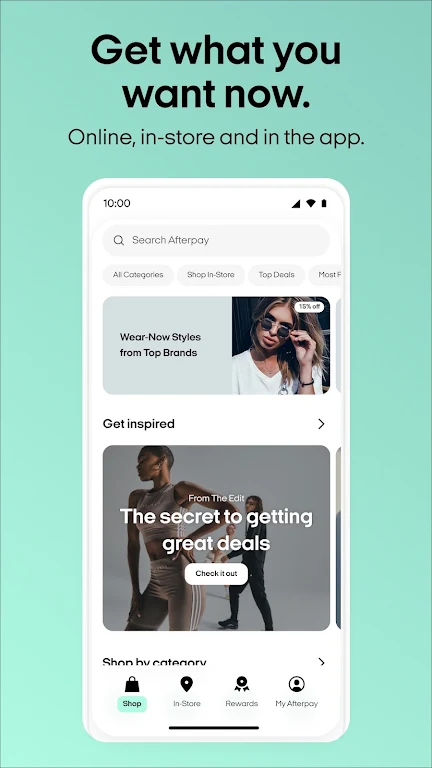

App-only shopping benefits: Afterpay provides exclusive deals and discounts accessible only through their app, connecting users with a broad spectrum of brands and products.

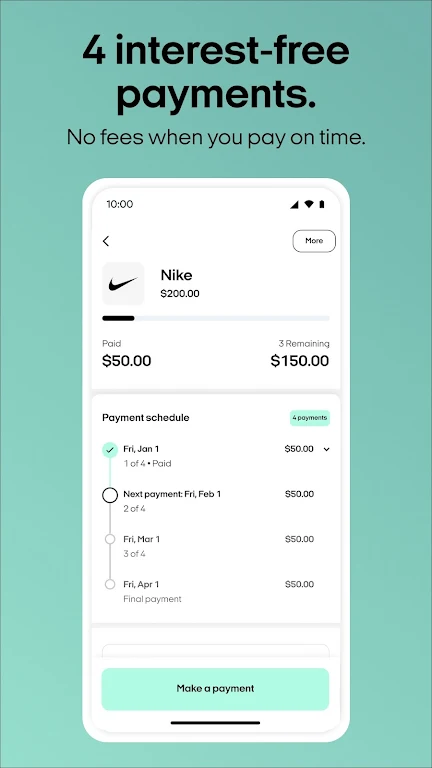

Pay in 4 interest-free payments: Break down your purchase into four easy payments, simplifying budget management.

Pay it in 6 or 12 months: For larger purchases, enjoy extended payment flexibility with options to pay over 6 or 12 months at participating brands.

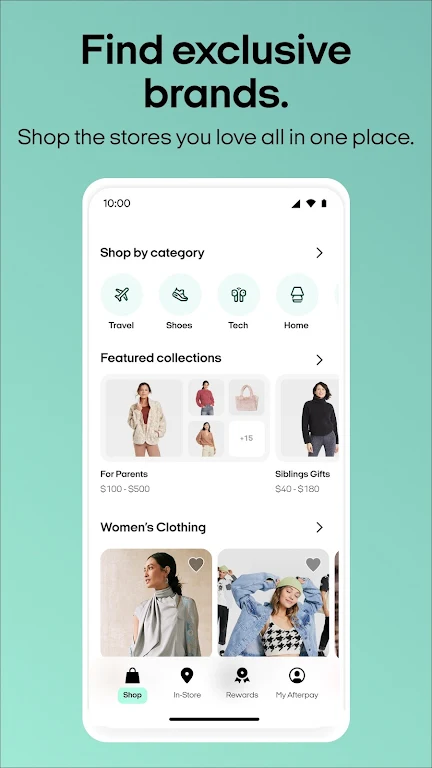

Exclusive app-only brands: Gain access to unique brands and products available exclusively on the Afterpay app.

FAQs:

Can I use Afterpay in stores?

- Absolutely, Afterpay is widely accepted at numerous in-store locations, enhancing your shopping experience both online and offline.

How do I manage my payment schedule?

- The Afterpay app makes it simple to adjust your payment schedule, pause payments for returns, and track your order history.

How do I receive alerts for sales and price drops?

- Turn on push notifications within the app to stay informed about sales and price drops on your favorite products.

App-Only Shopping Benefits

Afterpay offers a dynamic shopping experience exclusively via its app, providing access to a wide array of brand deals. Whether shopping online or in-store, you can utilize Afterpay to divide your purchases into four interest-free installments. The app lets you explore a variety of stores, brands, products, discounts, and gift cards across categories like fashion, beauty, home, toys, tech, and more.

Flexible Payment Options

Afterpay now offers enhanced payment flexibility, allowing you to pay in 6 or 12 months at select brands. This feature is perfect for managing the cost of larger purchases over a more extended period, helping you maintain control over your finances.

Exclusive Brands and Categories

Discover exclusive brands and categories only available through the Afterpay app, spanning fashion, tech, and beyond. The app also provides daily curated shopping guides and inspirational content, keeping you informed about the latest trends and deals.

Manage Your Orders with Ease

Effortlessly review your current and past orders and payment history with Afterpay. Adjust your payment schedule or pause payments when necessary for returns. For added convenience, you can link Afterpay to your Cash App account to manage your orders seamlessly.

Stay Informed with Sale and Price Drop Alerts

Stay ahead of the game with Afterpay's push notifications, alerting you to sales and price drops on items you've saved in the app, ensuring you never miss out on a great deal.

In-Store Shopping with Afterpay

Shop with confidence in-store by adding your Afterpay card to your virtual wallet. The app displays your pre-approved spending amount, helping you stick to your budget.

Increase Your Spending Limit

By consistently making on-time payments through the Afterpay app, you can unlock higher spending limits, empowering you to shop more while maintaining good financial habits.

24/7 Customer Support

Access round-the-clock customer support through the Afterpay app's chat feature. Get assistance and find answers to your questions at any time, with easy access to FAQs.

Terms and Conditions

To use the Afterpay app, you must agree to the applicable Terms of Use and Privacy Policy. Eligibility requires you to be at least 18 years old, a U.S. resident, and meet additional criteria. In-store use may require additional verification. Late fees may apply; see the installment agreement for full terms. Loans to California residents are made or arranged pursuant to a California Finance Lenders Law license.

For the Pay Monthly program, loans are underwritten and issued by the First Electronic Bank, Member FDIC. A down payment may be required, and APRs range from 6.99% to 35.99%, depending on eligibility and merchant. Loans are subject to credit check and approval and are not available in all states. A valid debit card, accessible credit report, and acceptance of final terms are required to apply. Estimated payment amounts shown on product pages exclude taxes and shipping charges, which are added at checkout. Complete terms can be found on the Afterpay website.