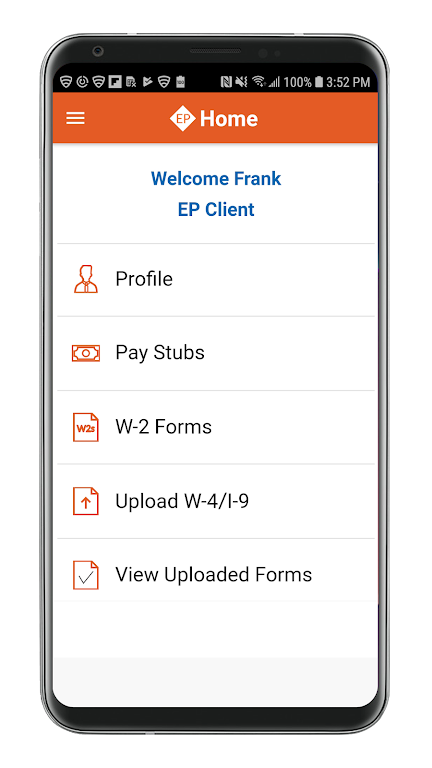

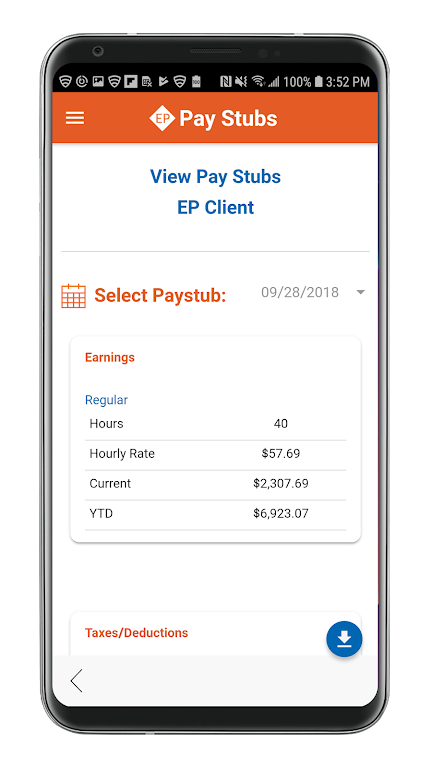

The Employee Portal Payroll Relief app puts you in control of your paycheck. Forget endless waiting – receive instant notifications the moment your salary is deposited. Access your pay stubs and tax forms anytime, anywhere, via 24/7 online access. This eliminates the need to chase down paper forms and provides complete transparency into your earnings. Securely upload your W-4 or I-9 directly from your phone, simplifying the process of providing crucial documentation to your employer. Updating your personal information is a breeze; simply adjust your address, phone number, or email within the app. Get started now! Contact your employer for your firm code, user ID, and password.

Key Features:

- Instant Payday Alerts: Never miss a paycheck again with immediate payment notifications.

- Round-the-Clock Access: Access pay stubs and tax forms 24/7 from any device.

- Secure Document Submission: Upload your W-4 and I-9 forms directly through the app, securely and conveniently.

- Effortless Profile Management: Quickly update your contact information directly within the app.

Frequently Asked Questions (FAQs):

- How do I access the app? Obtain your firm code, user ID, and password from your employer, download the app, and log in.

- Is the app secure? Yes, data transmission is encrypted to protect your personal information.

- Can I access past pay stubs and tax forms? Yes, the app archives your pay history for easy access.

- Will I still receive paper copies? Check with your employer to confirm if physical copies are still necessary.

In Conclusion:

The Employee Portal Payroll Relief app streamlines payroll management. Enjoy instant notifications, 24/7 access to documents, secure uploads, and easy profile updates. Download the app today for a simpler, more efficient way to manage your pay information. Your employer holds your login credentials – get yours and start enjoying the benefits!